October 2019 Newsletter

October 2019

Market Update

The third quarter of 2019 has come to a close, and with it, the S&P 500 Index (SPX) crossed the finish line with a 1% gain. On the face of it, 1% is hardly exciting but, when put in context, it’s rather notable. Consider the circumstances – the SPX gained a massive 13% in Q1 and followed that up in Q2 with still strong gains of 3.8%. Managing to extend the winning streak to the 3rd quarter is impressive, and it appears even more so in the face of the financial headlines we’ve seen.

You could make the argument that managing just a 1% gain in a quarter where the market saw two 0.25% interest rate cuts by the Federal Reserve isn’t all that awe-inspiring. But these cuts had been forecasted for months, and some market participants thought the cuts would be even deeper. What sticks out to us is the market’s ability to hold its gains in the face of overwhelmingly bad headlines.

Market headlines in Q3 were dominated by two things:

- The seemingly never-ending trade war with China

- An escalation of the discussion in both print and digital media of an impending recession

These are directly connected. In early August, President Trump made headlines when he tweeted about an escalation in tariffs, and he followed that up days later by accusing the Chinese of manipulating their currency. These events hit the market at the height of a two-month rally and prompted the SPX to dump 5.6% in just 4 days’ time. In turn, the drop set off a slew of recessionary fears in the media.

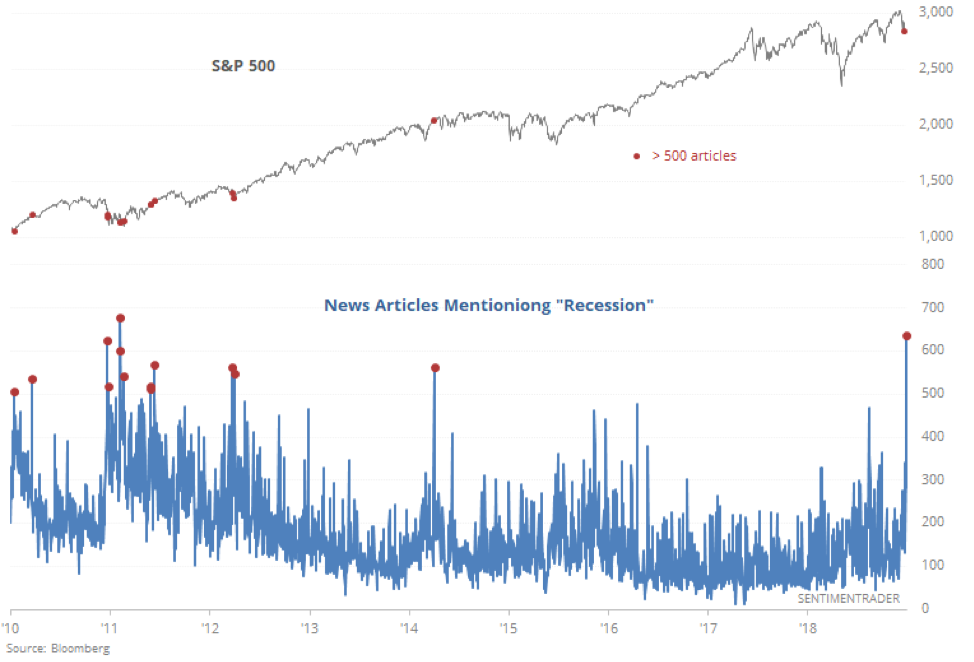

Consider the chart below:

The number of articles mentioning “recession” spiked above 600 for just the third time since the financial crisis in 2008, and for the first time in five years. Certainly, there are reasons for concern. The yield curve has narrowed, value stocks are beginning to outperform growth stocks, late-cycle assets such as commodities are showing relative strength, and the trade war is in danger of materially affecting GDP. Of course, anything is possible in the future, but we feel recessionary fears are overstated at this time.

Data in August saw increases in building permits, housing starts, and industrial production1. This goes along with continued strong consumer spending that is supported by low unemployment, steady wage growth, contained inflation, and low interest rates. Generally speaking, these are all not the data points we’re likely to see in the face of an impending recession.

As we state in every market commentary we, of course, don’t hold a crystal ball as to what is in store for the markets. Asset allocation and planning for your individual time horizon and needs are the keys to successful long-term investing. This commentary is not to be interpreted as any specific personal recommendation.

If you have any questions about our analysis or want to speak in further detail about the market, please don’t hesitate to call or email us.

Best,

Nathan

President, Kuhn Wealth Management

How We Stay Current on Alternative Investments

Kuhn Wealth Management is a member of The Alternative & Direct Investment Securities Association (ADISA), the nation’s largest alternative investments association. As members of ADISA, we regularly benefit from their three pillars: information and education; networking with peers, professionals, leaders, and regulators; and legislative and regulatory advocacy. It is one way we stay current on alternative investments.

Every year, ADISA hosts an annual conference designed for industry professionals. In mid-October, we attended this conference to participate in educational sessions and meet face-to-face with over 1,000 leading professionals and exhibitors. The ADISA conference is something we look forward to every year as it keeps our knowledge current and we are able to foster relationships—all things that benefit our clients.

This year, we joined sessions that focus on the various aspects of our business. In particular, we focused on those that relate to alternative investments such as real estate limited partnerships and DSTs that we utilize for clients in 1031 exchanges. In one session, a Counselor to the US Department of the Treasury, Daniel Kowalski, discussed the 2016 tax reform. He also offered insight into what we might anticipate happening in the future from a tax standpoint.

Another session focused on evaluating real estate investments and assessing them beyond the superficial attributes of the property and its location. We discussed how other factors such as leverage utilization, structure, and capital budgets and reserves can and need to be considered.

From a networking perspective, the ADISA conference is a wonderful opportunity for us to share best practice ideas with other top advisors. We also take time to meet one-on-one with key people at various companies who have investment offerings we can offer to our clients.

A highlight of this year’s conference is keynote speaker Roger Staubach, aka “Roger the Dodger.” Roger, a former Dallas Cowboys quarterback and NFL Hall of Famer, is well known by fans for his 1971 MVP season, 6 Pro Bowls, as a 4-time NFL passing leader, and 2 Super Bowl wins. While all of us here are certainly football fans and are looking forward to hearing about Roger’s NFL insights and memories, we were also excited to learn more about his real estate business. Roger started his company, The Staubach Company, in the late 1970’s and eventually sold part of it to Jones Lange LaSalle for over $600 million. It’s safe to say there were some good insight and takeaways from him!

Each year we attend the ADISA conference—and it’s been five years and counting—we have found it to be a worthwhile investment of our time.

Between everything we learn and everyone we meet, it helps us to stay current on alternative investments and keeps us well situated to advise our clients.

We will share more specific details about the sessions we attended and the knowledge we gained. In the meantime, if you would like to talk about alternative investments or learn more about how we stay current on them, don’t hesitate to reach out.

Current Investor Opportunities for Opportunity Zones

In our last newsletter, we introduced you to Opportunity Zones. Today, we’ll share more about our current investor opportunities for Opportunity Zones.

Here at Kuhn Wealth Management, we emphasize the importance of having a financial plan you’re confident you can stick with and why you shouldn’t let short-term market gyrations influence your long-term investment decisions. While recent volatility has raised concerns about the strength of the stock market, it’s worth remembering that the strong performance we’ve seen over the last several years has benefited investors.*

Today, many of these investors are in a position and have a desire to realize some of the gains they’ve achieved. Of course, capital gains taxes are always a concern. Fortunately, in the right situations, opportunity zone investments might offer a solution for investors to realize potential gains, diversify their portfolio, and defer and potentially reduce tax liability. (Need a refresh on the tax benefits of opportunity zone investments? Here’s our previous article.)

Currently, we are working with three sponsors who have qualified opportunity zone investments available to our clients. We are also evaluating other investments on a regular basis and we anticipate offering additional opportunity zone investments in the future. Please be aware these investments are only available to accredited investors.

All three of the current opportunity zone investments are focused on real estate and are primarily real estate development. The funds range in target size from $30 million to $275 million, and the minimum investment starts as low as $50,000.

When evaluating opportunity zone investments at a high level, it’s helpful to note there are two distinct types of offerings: 1) a defined asset and 2) an investment fund or pool investment. One investment currently available is a defined asset. The intention of the sponsoring firm is to develop a hotel and multi-family building on what is currently a parking lot adjacent to a major sporting and events venue.

The other two offerings are structured as pool investments. These firms may have assets already identified or even purchased, and also expect to add additional properties in the future. One fund intends to focus on hotel development, primarily in metro and college campus locations. The other fund offering has a broader approach.

If you are interested in learning more about opportunity zone investments or reviewing offering materials, we’d love to help. Please don’t hesitate to contact us.

*Past performance does not guarantee future results.

Online Access to Your Accounts

Our clients have the benefit of online access to consolidated financial reporting. If you have not already done so, it’s easy to request access to your accounts. Within 2-3 business days of requesting your account access, you will receive an email from our broker/dealer, Concorde, that will direct you to:

- 1. Click the link provided

- 2. Enter your unique Access Code

- 3. Set up a username and password

If you have any questions or prefer to request access by phone, please call us at (847) 607-4976.

As of 10/15/2019. This is for informational purposes only and does not constitute an offer to buy or sell any investment product. The opinions expressed are those of the writer and does not necessarily represent the views of their affiliates. Past performance and predictions are not a guarantee of future results. The material contained herein is obtained from sources believed to be reliable, but its authenticity, accuracy or completeness is not guaranteed. Projections are inherently limited and should not be relied upon as an indicator of future results. Investments in securities involve a high degree of risk and should only be considered by investors who can withstand the loss of their investment. The S&P® 500 Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. Direct investment in an index is not possible. Accredited investors typically have a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last three years. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney.

Because investor’s situations and objectives vary, this information is not intended to indicate direct investment advice and suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation.

Securities offered through Concorde Investment Services, LLC (CIS), Member FINRA/SIPC. Advisory services offered through Kuhn Wealth Management, Inc., a state registered investment advisor. Kuhn Wealth Management, Inc. is independent of CIS and Concorde Asset Management, LLC. All of whom are unaffiliated with third party sites, and cannot verify the accuracy of nor assume responsibility for any content of linked third party sites. Information available on third-party sites is for informational purposes only.